Price War in Oligopoly Market

Oligopoly is an imperfectly competitive market form, where there are few sellers and a large number of buyers, and the product may be homogeneous or differentiated. Since there are few sellers, so there arises Conscious Rivalry among the firms. That is, if a firm takes any action or strategy, then it influences the act or strategy of its rival firm. This mutual interdependence leads to strategic interactions between the firms.

When the firm’s strategies on their own without cooperating with its rival firms, or without any explicit or implicit agreement, then this leads to non-collusive oligopoly, producing ‘price wars’ among each other.

Case I: When the conjectural variation is zero, i.e., when a firm changes its price, it considers the price of the rival firm remains unchanged. Here, the firms’ objective is to maximize profit. The profit functions can be written in a duopoly case as,

Π1 = Π1(P1,P2) and Π2 = Π2(P1,P2)

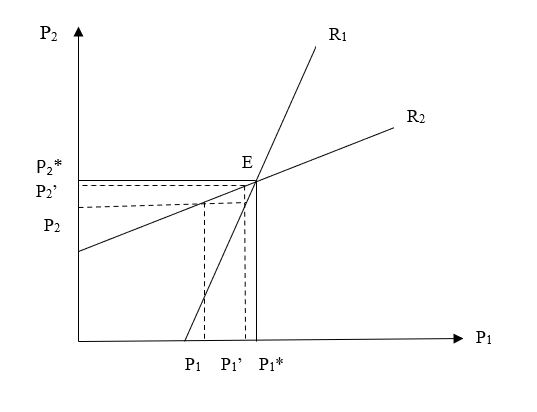

Suppose the first firm assumes P2 as constant and selects P1 in such a manner that its profit maximizes. In this way, we get different combinations of P1 and P2, which gives the price reaction curves of the firms R1 and R2.

If the first seller’s price is P1, then firm two assumes that firm one will maintain P1 price, and so to maximize its profit, he chooses P2. Again, corresponding to P2, the first seller fixes his price level at P1‘, to maximize his profit. In response to this, the second seller fixes his price at P2‘ and thus, we see that with the advent of time, the price level approaches the equilibrium value E at P1* and P2*.

Case II: When conjectural variation is non zero, there arises the problem of price leadership. Naturally, the leader gets some advantage, as it sophisticatedly incorporates its rival’s reaction function and accordingly maximizes his profit. In this process of becoming price leaders, both the firms end up earning lesser profit. Because each of them is stuck to the assumption that other’s behavior is governed by his reaction function, but in fact, neither of the reaction function is obeyed. As a result, both the sellers lose in this non-cooperative strategy, and a price war is inevitable.

The fact that the leader gains and the follower lose has the possibility that both the sellers will aspire to be leaders. If this happens, we get disequilibrium where both the sellers land into much worse positions. Considering the following pay-off matrix, the strategy ‘Leader’ is the dominant strategy for both the sellers, but as a result, they are worse off than the (Follower, Follower) strategy.

| 1st Sellers’ Strategy | 2nd Seller’s Strategy | |

| Leader | Follower | |

| Leader | (2,2) | (10,1) |

| Follower | (1,10) | (5,5) |

This act of price leadership, leading to a price war, ends when one of the firms surrenders and agrees to act as a follower, or a collusive agreement is reached with both the firms.

For more such insightful writings, feel free to connect with EduManta, which brings some young talents to guide you with the best of their knowledge and understandings in your concerned field. Visit: http://www.assignmenthelp.edumanta.com/ for assignment help and tutoring.