Question:

Analyze the change in oil prices in the last one year and its impact on the Balance of payment of the country.

Answer:

Oil is one of the most major sources of energy which contribute 27.3% of global primary energy demand. Oil is a limited resource and will not last forever. In 2015, oil reserve to production ratio was at 50.7 which means if oil continued to produce at this rate, it would last about 51 years. Thus scientists are working hard to explore alternate sources of energy. Besides, those geoscientists are busy finding out new sources of oil and exploring unexplored reserves. Tight oil and shale oil are becoming techno-commercially to produce and market. In recent times, unconventional oil and gas resources significantly impacted the dynamics of global oil & gas trade. In fact, these unconventional oil resources have increased the supply of oil in the global market which resulted in a fall in global oil prices. Moreover, the OPEC liberalized its high price policy by cutting the production significantly against its prior policy of producing an artificial shortage of oil in the global market to increase the price. The graph below is showing how the high oil price in 2014 fell significantly at the end of 2014.

The figure below shows International Oil prices from Jan 2014 to Aug 2018

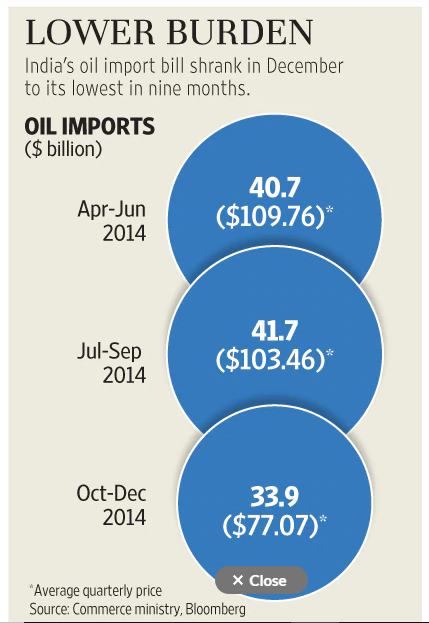

Lower oil prices shrank India’s oil import bill when the oil prices fall from $110 per barrel to less than $45 per barrel in January 2015. In December 2014, oil imports fell 29% to $9.9 billion from $13.9 billion as compared to the same month of 2013. At this time there was slower growth in gold imports, helped India to lower its import bill and narrow its trade deficit in the month.

The fall in import bill in 9 months in by 4.78% to $33.9 billion, mainly because of lower oil imports, but on the other hand, exports dropped 3.77% to $25.3 billion. As the fall in imports was greater than the fall in export, it narrowed the trade deficit to $9.4 billion from $10.1 billion a year ago. The fall in oil prices will help the government to lower its subsidy burden as well as provide some relief to the external sector by keeping the current account deficit in check and hence ease pressure on the rupee. More correction in crude oil prices will improve India’s current account balance.

The figure bellows shows the shrank in import bill due to the fall in oil prices in 2014.

Recently the plummeting rupee and increasing fuel prices due to global factors set to weakling already weekend currency, widen current account deficit and affect its growth outlook. Rebounding oil prices after huge fall from 2014 in combination with India’s unrelenting demand for oil will push up oil imports and widen its current account deficit that measures the flow of goods, services, and investments. The increasing deficit will further weaken rupee, as more imports mean the country will need to buy more foreign currencies to meet its needs. This challenging global environment has made the Reserve Bank of India (RBI) intervene aggressively this year to contain rupee depreciation and also the drawdown in foreign reserves has been significant.

India’s is a country that heavily relies on imported oil and gas, the rising world oil prices have significantly inflated the oil import bill. Due to this India’s trade position deteriorating, with July’s trade deficit hitting a five year high. Oil prices have shot up this year, reaching $80 a barrel in May for the first time since 2014. The OPEC-led output cut, falling Venezuelan and Libyan output, as well as by an imminent drop in Iranian exports as U.S. sanctions return in November this year boosted the oil price to the highest. It is being speculated that the oil import bill in the fiscal year 2019 could spike above $114 billion. Oil imports were about $88 billion between 2017 and 2018 which is higher than the previous year’s cost of $70 billion.

India needs to bring its oil demand down that will lower the oil imports; this will help India to make growth more resilient. According to a report, India’s oil demand will increase to 4.4% annually in the next ten years, compared to 3.7 per year in the last 10 years. This rising oil imports can hit India’s gross domestic product badly in the long term.

Question:

Also, analyze its impact on your company.

Answer:

Altran Technologies SA, a technology consultant main business areas are as follows:

- Automotive industry – Due to continuous increase in oil prices and limited availability of oil resources the company is increasing the budget development of autonomous and connected vehicles and tackling the related safety and security issues; environmental issues (energy efficiency, electric vehicle) and development of so-called “green” mobility; and search for new mobility models.

- Aeronautics – It has also increased its R&D in developing fuel-efficient aircraft and align its properties according to the Industry 4.0 norms.

- Space, Defense, and Naval – This sector needs huge energy resources that are provided by oil and increasing oil prices to have a significant impact on its cost sheet.

- Energy – In the oil and gas segment the increase in the price of the oil help them to increase their top line but this might now be a permanent solution as there is regular research going on developing alternative and unconventional energy resources such as sail oil etc.

- Industry and electronics – n the electronics and semi-conductors segment, growth should be driven by the search for electronic components that are more rapid, miniaturized, mobile and low in energy consumption, on the one hand, and by the development of embedded systems, particularly for the automotive industry, and connectivity with the Internet of Things (IoT), on the other hand.

Thus we can see Altran Group has high exposure to oil and gas prices as its business is concerned. The effect of high oil prices can be seen in the basic financial ratios of the company given below.

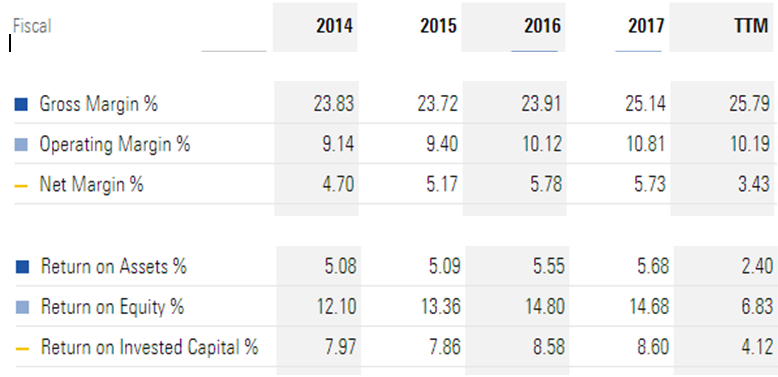

The figure below show profitability ratio of the company for last 5 year.

We can see hoe the Profitability ratio has gone up from 2014 to 2016, but it’s coming down henceforth. This is basically because the company was able to bring its operating expenses down when the oil prices were going down but after 2017 when oil prices started going up, it started hitting the profits of the company.

Oil prices can hit the company in two ways, in the automotive industry, for instance, the oil is a complimentary product to cars, the demand for which comes down as in the reign of high oil prices the consumers postpone their purchases. In can of the energy sector, the product itself is oil and an increase in the price may increase the revenue of the company but it can also drop the overall demand on the flip side. In a heavy industry where there is a high need for power for which oil can be the primary source of energy, oil being at a higher price will increase the cost to the company and that will pull down the profits of the company.

Reference:

- https://www.altran.com/as-content/uploads/sites/8/2018/03/2017-registration-document.pdf

- https://www.zonebourse.com/ALTRAN-TECHNOLOGIES-4610/pdf/819067/Altran%20Technologies_Slide-show-presentation-resultats.pdf

- https://www.ft.com/content/c9ae9d88-0944-11e5-b643-00144feabdc0

- https://www.wsj.com/articles/companies-feel-the-impact-of-rising-oil-prices-1524786472